CIES Football Observatory Monthly Report

n°18 - October 2016

Recruitment strategies throughout Europe

Drs Raffaele Poli, Loïc Ravenel and Roger Besson

1. Introduction

The 18th Monthly Report of the CIES Football Observatory analyses the recruitment strategies followed by clubs from the five major European championships. The study investigates the transfer modalities of players present in squads in October 2016, fielded in domestic league games during the current season or having played in adult championships during each of the two preceding ones.

The Report shows that the most competitive teams pursue a transfer strategy based on quality. They focus on the fee paying transfer of young players with high potential and hold on to those who perform best over the long term. In addition, the wealthiest teams tend to recruit more internationally than those with lesser means at their disposal.

2. Supply sources

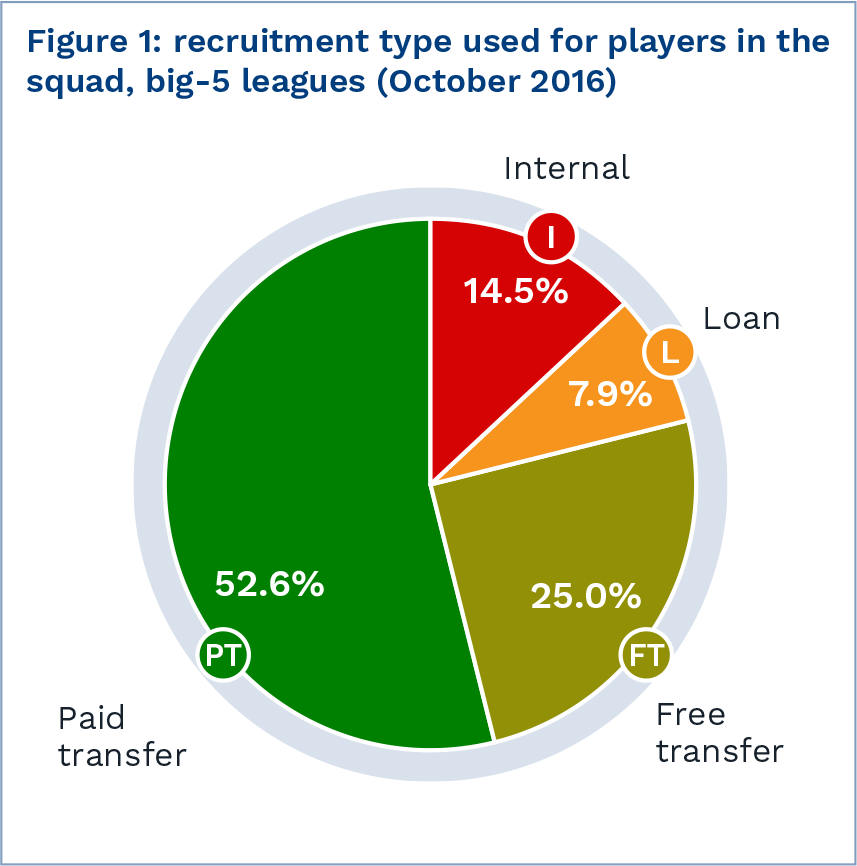

To make up their squads, clubs take on players from their youth academy (internal recruitment) or from other teams (external recruitment). For the latter case, three different recruitment methods are possible: temporary (on loan), permanent paid transfer and permanent free transfer. The most common type of signing at big-5 league level is permanent paid recruitment.

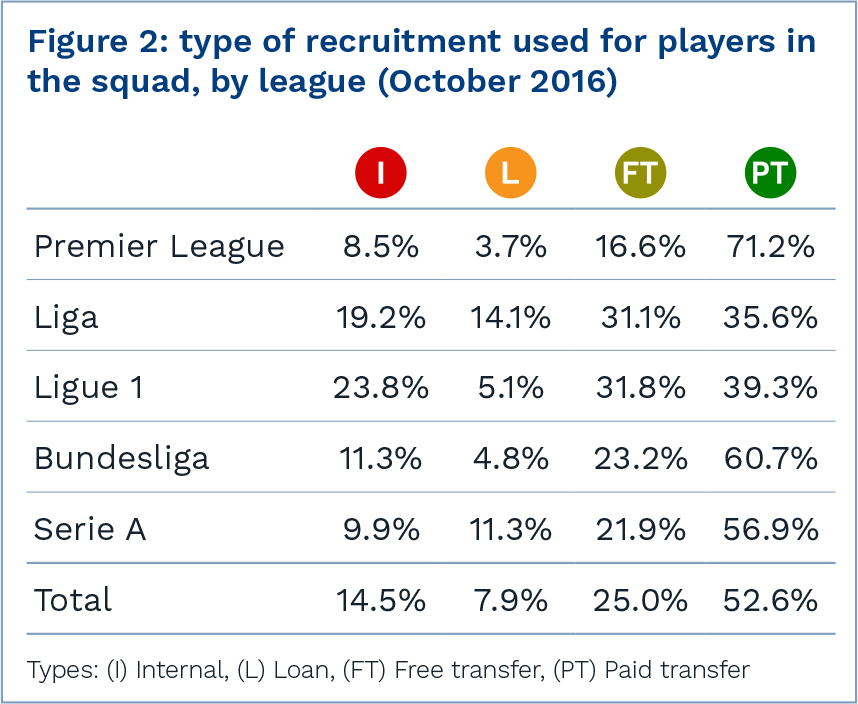

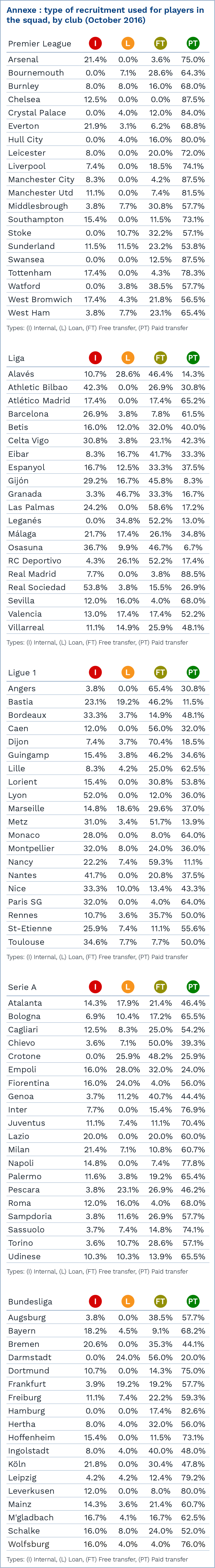

Important differences in the method of recruitment of players exist according to league. Though the permanent paid transfer is the most common for all the championships analysed, the percentage of this signing modality varies between 71.2% for the English Premier League and 35.6% for the Spanish Liga.

Considerable differences also exist between the other types of recruitment. Thus, 23.8% of French Ligue 1 players are from youth academies, compared to just 8.5% in England. Only 3.7% of Premier League footballers are on loan, compared to 14.1% in the Spanish League. The percentage of permanent free transfers varies between 16.6% in England and 31.8% in France.

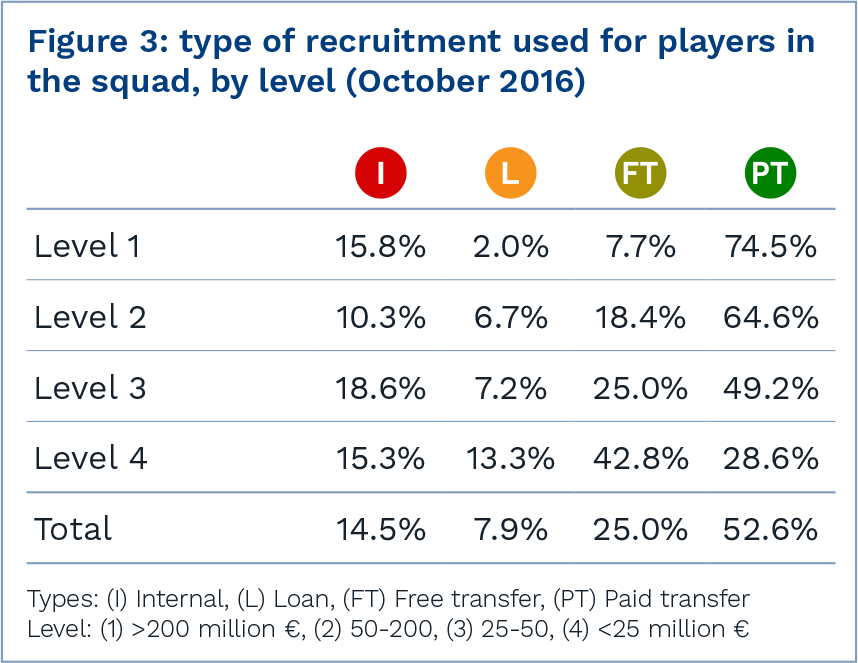

The differences in the recruitment methods are also very clear when taking into account the sporting and economic level of teams. To determine levels, four categories were established based on the transfer fee expenditure of clubs to sign players in their 2016/17 squad: less than €25 million, between €25 and €50 million, between €50 and €200 million and more than €200 million.

While the differences for internal recruitments are small, the differences in the recourse to loans are much more marked: from 2.0% for the richest clubs to 13.3% for the less well off ones. Similarly, the percentage of permanent free transfers varies between 7.7% for the former and 42.8% for the latter. The percentage of permanent paid transfers changes in the opposite manner: 74.5% for the wealthiest clubs and 28.6% for those with the least means at their disposal.

At the level of clubs, the record values according to the type of transfer were measured for Real Sociedad for player from the academy (53.8%), Granada (46.7%) for loans, Dijon (70.4%) for permanent free transfers and Real Madrid (88.5%) for permanent paid transfers. The distribution according to the type of recruitment for all of the big-5 league clubs is available in the appendix.

3. Arrival timeline

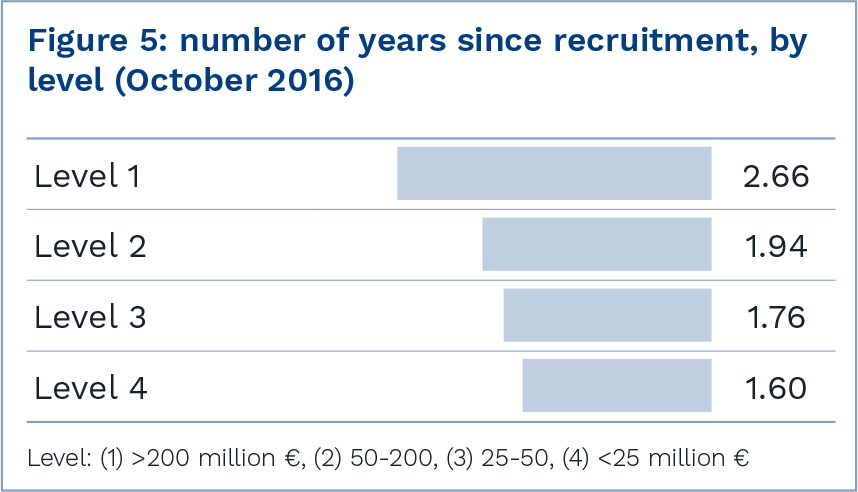

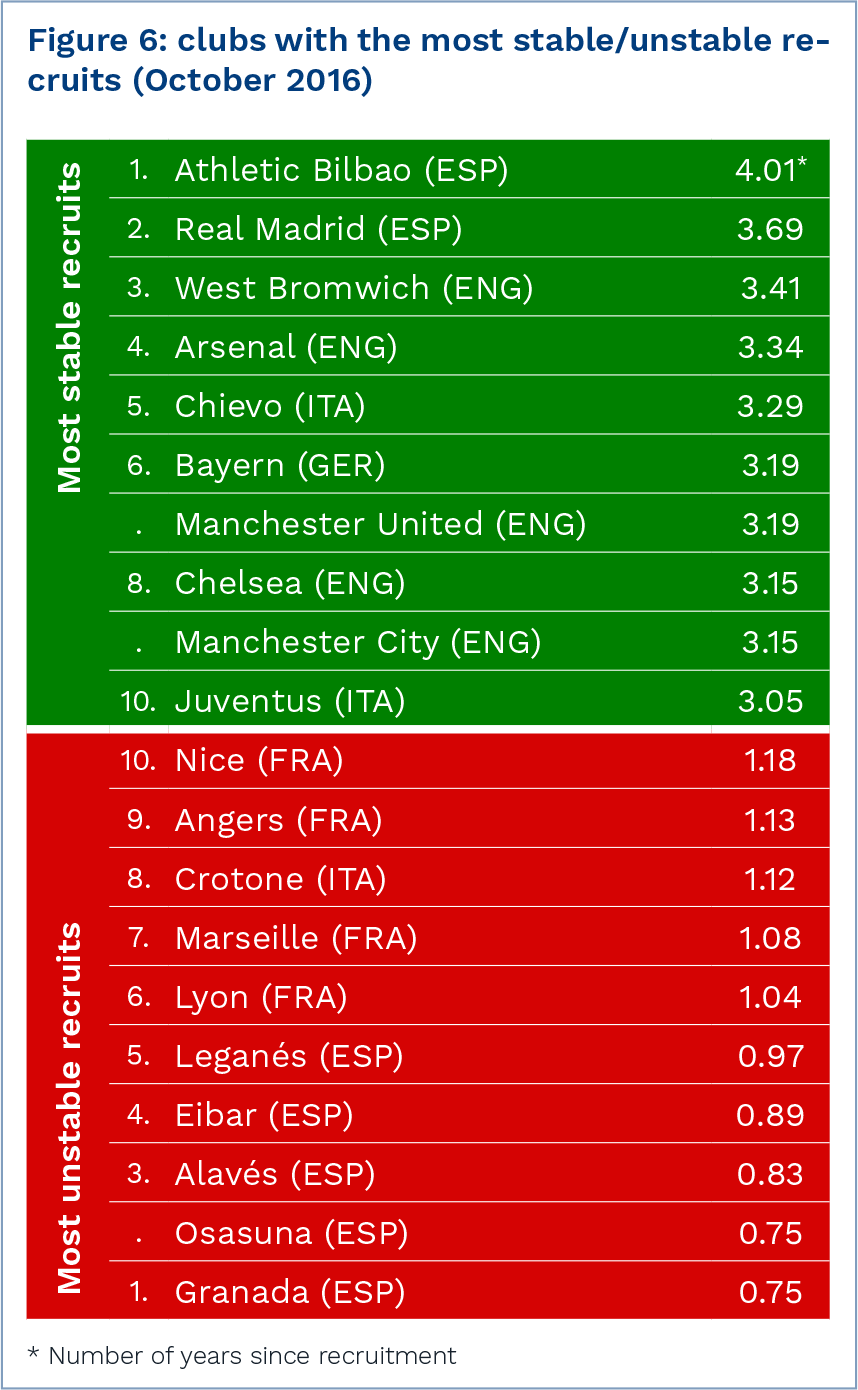

The arrival timeline in a club refers to the semester during which current squad members were recruited. Players promoted from the academy to the first team squad are not included in the analysis. On average, footballers present in the big-5 leagues in October 2016 are in their employer club since 1.9 years.

The analysis by league and club level again bring to light important gaps. Players from English clubs were recruited since a longer period than footballers from other championships: 2.3 years on average on the 1st October 2016.

This result is linked to the economic strength of English clubs. Premier League teams can indeed allow themselves to focus their recruitment on the players most under the spotlight and offer new signings long term contracts. Furthermore, they can, without qualm, let go footballers who are not giving satisfaction and, inversely, keep on long term the best performing elements.

The above assessment is also valid for the richest clubs in comparison to teams with lesser means. Consequently, the former, generally speaking, have a much more stable squad than the latter. This situation gives them a competitive advantage that is often reflected in results.

Numerous wealthy and well performing clubs are at the top of the rankings for teams whose external signings have been long standing members in the squad. At the opposite end, with the exception of Lyon, clubs whose signings have more recently arrived are not among the most competitive in their respective leagues.

4. Recruitment age

The analysis of the age of players when they were recruited by the club represented in October 2016 also allows us to highlight important differences in transfer policies. Footballers from the youth academy are not included in the analysis. For players returning from loan, we have taken into account their age when they were first recruited by their employer club.

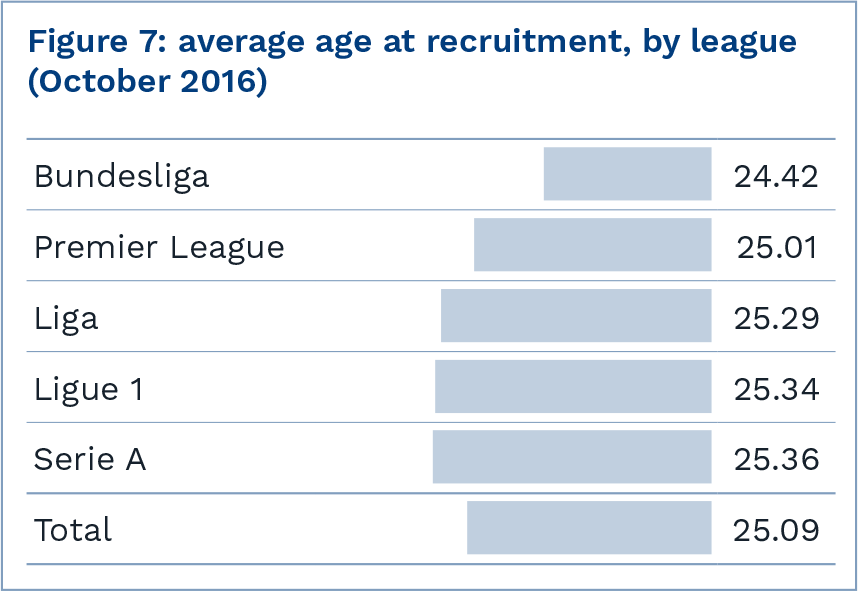

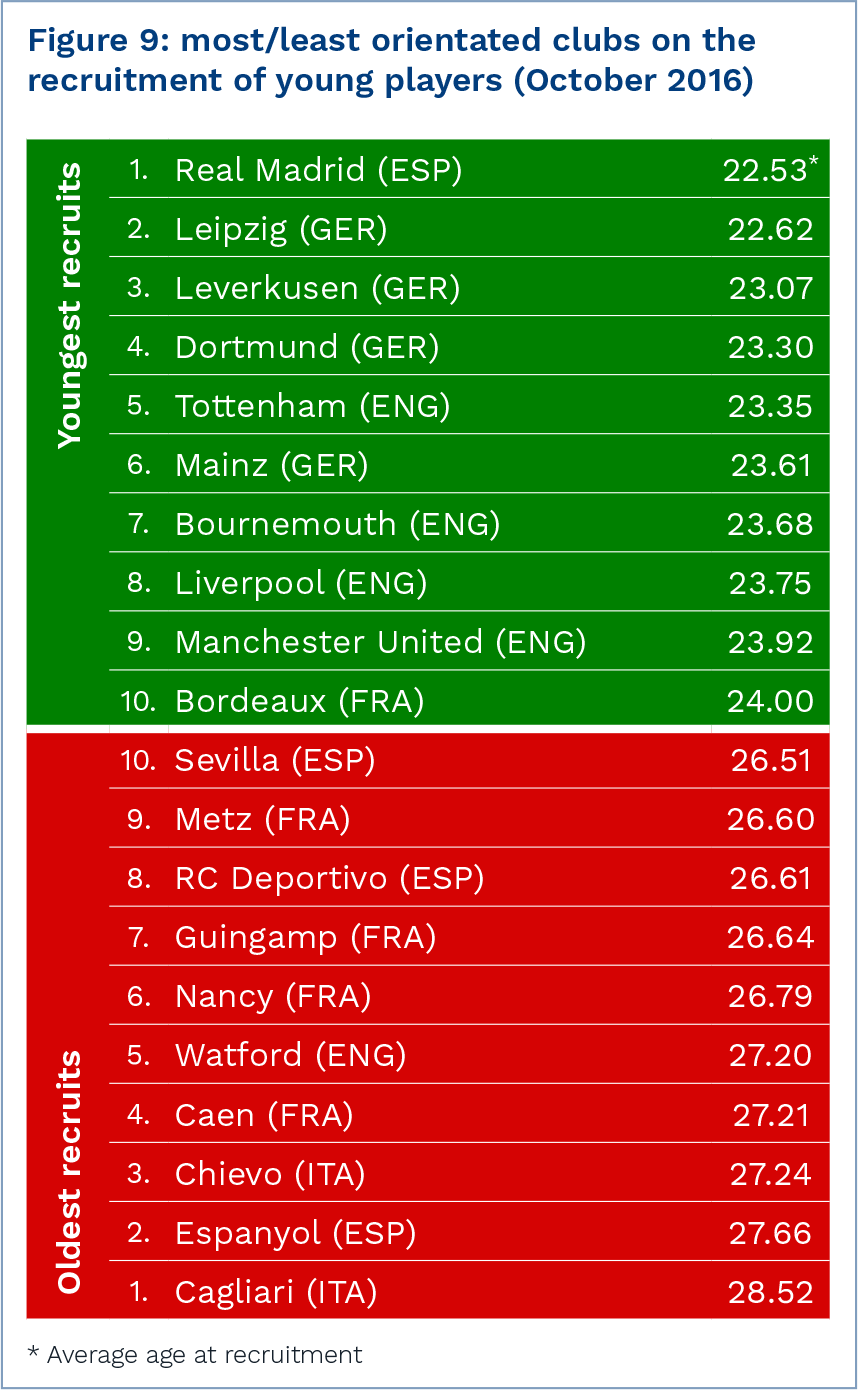

On the big-5 league level, the average age of players when they were signed is 25.1. Bundesliga teams focus the most on young talents. Their external signings were on average aged 24.4 years at recruitment. Conversely, Italian teams generally target more experienced players: 25.4 years.

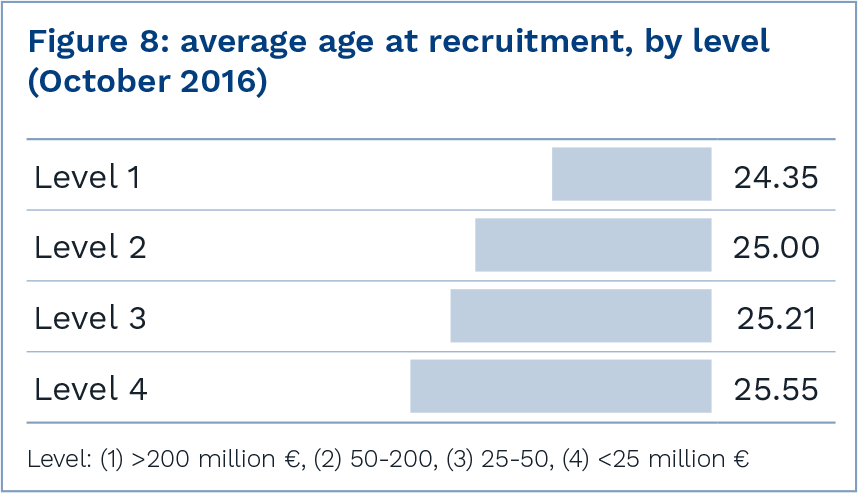

The analysis according to club level illustrates the tendency for clubs investing the most on the transfer market to recruit younger players compared to others. Thanks to their financial means, the top clubs target their transfer policy on players with a high potential. On the other hand, due to either necessity or choice, the lesser performing teams rely more on older footballers.

The average age of recruitment for big-5 league teams varies between 22.5 years of age for Real Madrid and 28.5 for Cagliari. The average level of clubs focussing more on young players is much higher than that of teams whose transfer policy is centred around more experienced footballers.

5. Level before recruitment

The experience capital is a composite indicator developed by the CIES Football Observatory to take into account conjointly the level of employment of players and the level of clubs represented. We consider here the experience capital accumulated by players over the twelve months preceding the transfer to their current club. Footballers promoted to the first team squad from youth academies are not considered.

[* For more information, please refer to the CIES Football Observatory Monthly Report 14]

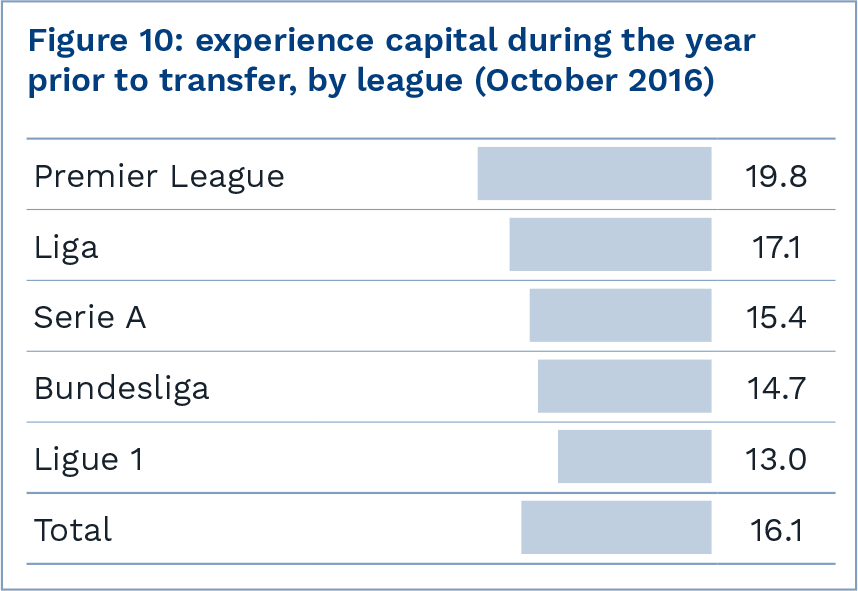

The average experience capital of new signings during the year prior to transfer is 16.1. The highest value was measured in the Premier League. This result again shows the financial clout of English clubs. From this standpoint, it is not surprising to note that the lowest value was recorded in the French Ligue 1.

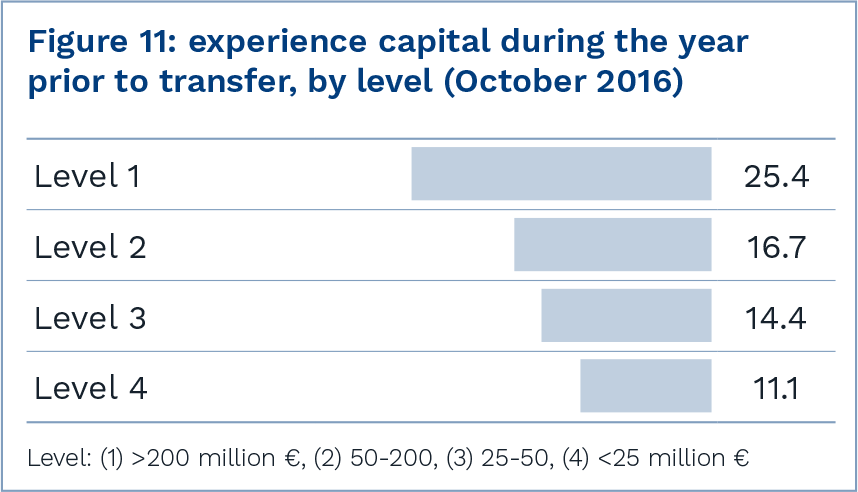

The differences according to the level of clubs are even more marked. The experience capital of recruits of the wealthiest teams is over twice that of the less well off clubs. The difference between teams having invested more than €200 million to make up their current squad and those having spent between €50 and €200 million is also very marked: +52%. The domination of the big clubs reflects this difference.

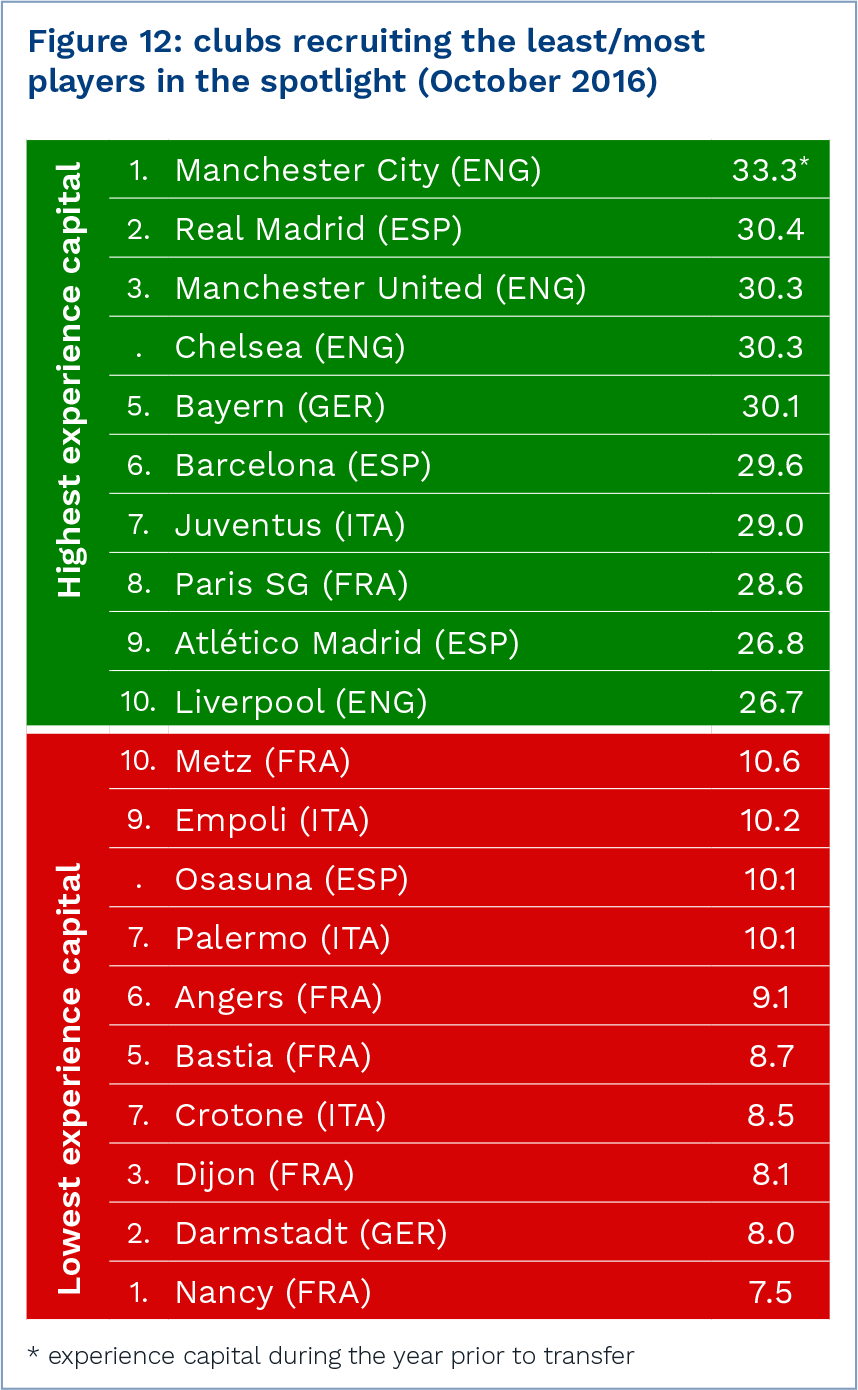

The highest value for experience capital during the year preceding the transfer was recorded for Manchester City: 33.3. With the exception of Dortmund, all the teams that have qualified at least once for a Champions League final since 2010/11 are present in the top ten rankings: Barcelona, Manchester United, Bayern Munich, Real Madrid, Atlético Madrid and Juventus.

6. Geography of recruitment

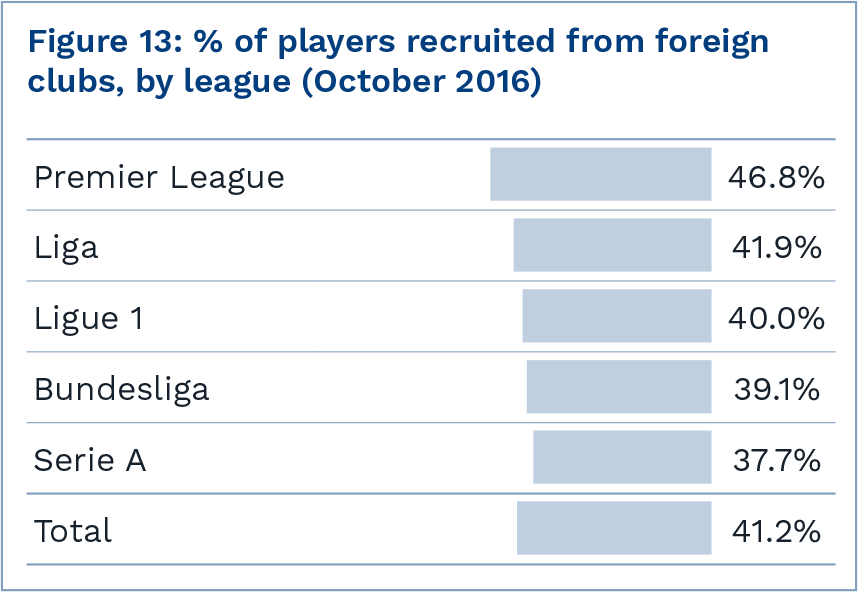

The legal constraints on the international recruitment of footballers have been progressively done away with since the early 1990’s. Though quotas still exist, they are far less restrictive than in the past. In total, 41.2% of players present in the big-5 leagues in October 2016 were recruited from abroad by their current team.

Premier League clubs have the most international recruitment at 46.8%. Though the level of foreign players in Italy is almost as high as in England, the percentage of international recruitments is 10% lower. This gap is mainly explained by the high level of internal mobility of expatriate players in Italy.

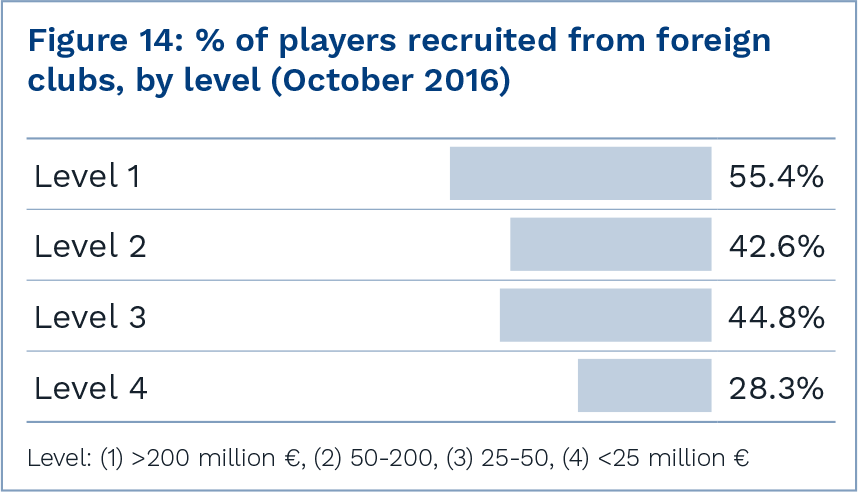

The clubs investing the most on the transfer market have a substantially more international recruitment than the others. More than half of the players from the top teams have been recruited from abroad (55.4%). This percentage is only 28.3% for clubs having spent less than €25 million in transfer fees while putting together their current squad.

The financial possibility to target the very best talents stimulates the internationalisation of recruitment areas. Nevertheless, the wealthiest clubs are not inclined towards risk taking. They indeed often prefer to recruit players who have already proven themselves in the most competitive championships, in particular the four other major European leagues, Portugal and the Netherlands.

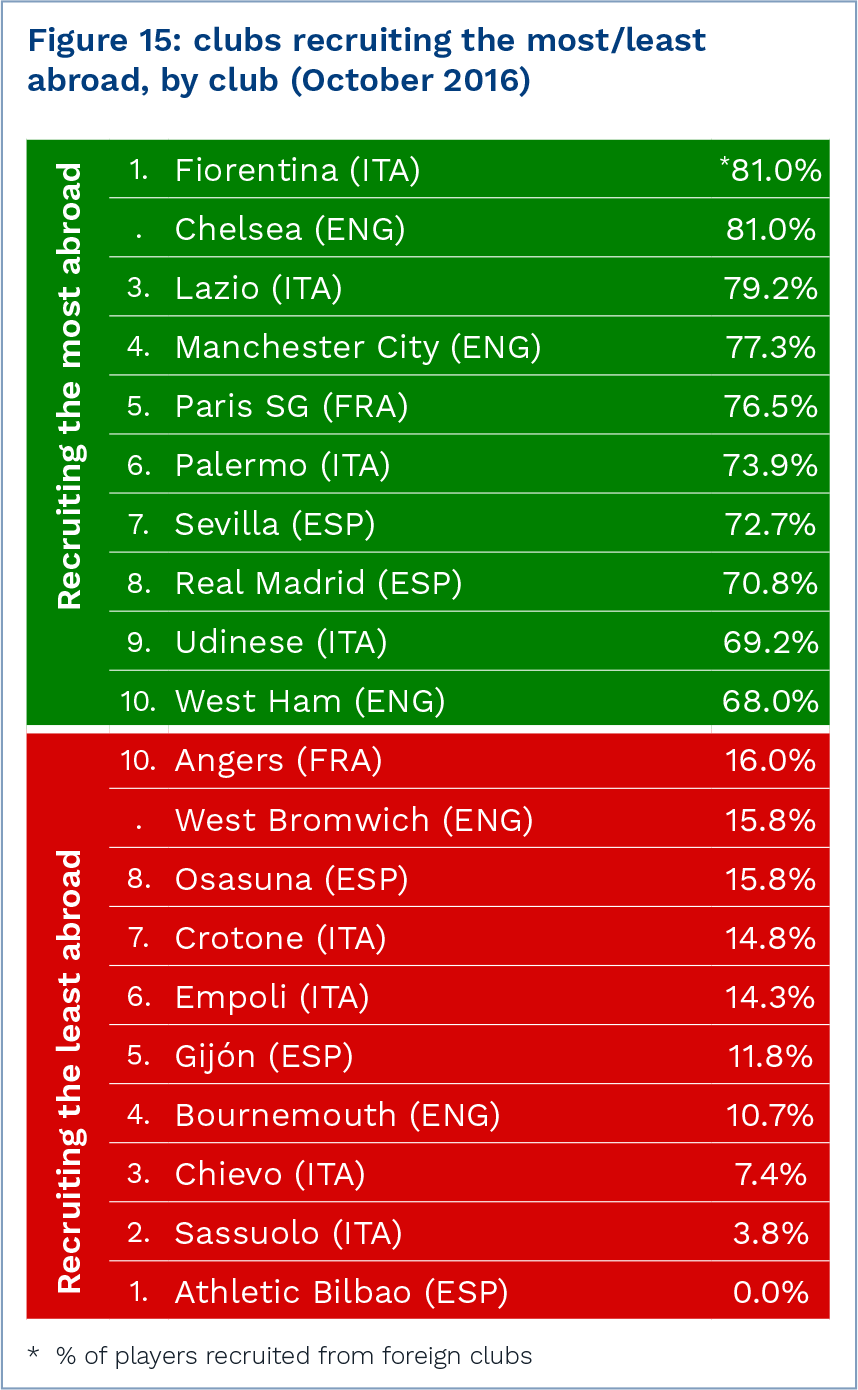

At one extreme, no member of the Athletic Bilbao squad was recruited abroad. Sassuolo and Chievo also focus their signing policy nationally. At the other extreme, 81% of players from Fiorentina and Chelsea were imported. Alongside Chelsea, in the top ten of clubs with the most international recruitment are many other wealthy teams: notably Paris St-Germain, Manchester City and Real Madrid.

Monthly Report n°18 - October 2016

Recruitment strategies throughout Europe